.png) The Crowd Funding

Ebook

The Crowd Funding

Ebook

.png)

By Michael R. Courtois

The Crowd Funding Ebook Download

UNDER CONSTRUCTION

(these are just my notes

for now)

Crowd Funding:

The Infant Industry

The Real Birth Of

Crowdfunding

In the summer of 1885,

crowdfunding solved a crisis that threatened the completion of the Statue of

Liberty. The City of New York refused to pay for the completion of the base

foundation. The "World" donated, supported and saved the Statue of Liberty. This

action gave birth to crowdfunding in American politics. More than 100 years

after the construction of the Statue Of Liberty, micro-financing became popular

in the Political realm. Politicians and interest groups caught on to the amazing

potential crowdfunding had to offer and are still using it to further their

causes.

The

Rise Of Crowdfunding

In the 2008 Presidential Election, Barack

Obama made Political history by becoming the first African-American

president while revolutionizing campaign financing through a crowdfunding

"platform". Four years later, Obama used the same strategy to defeat Mitt

Romney. Another name for crowdfunding in Politics that you may recognize is

"RALLY" (campaign rally).

Obama had put together and signed

the crowdfunding JOBS Act into law that has legally opened the door to

crowdfunding for the "mom and pop" (the public) investors to support investments

for Startups, Charities, Foundations and Personal "Causes". Crowdfunding

donation and support programs became legal for everyone and not just for

politicians.

The Jumpstart Our

Business Startups Act,

or JOBS Act, is a law intended to encourage funding of small businesses in the

United States by easing many of the country's securities regulations. It passed

with bipartisan support, and was signed into law by President Barack Obama on

April 5, 2012. Title III, also known as the Crowdfund Act, has drawn the most

public attention because it creates a way for companies to use crowdfunding to

issue securities, something that was not previously permitted. Title II went

into effect on September 23, 2013. On October 30, 2015, the SEC adopted final

rules allowing Title III equity crowdfunding. These rules went into effect on

May 16, 2016. Other titles of the Act had previously become effective in the

years since the Act’s passage.

The

idea of crowdfunding isn’t a new one. Back in the 18th and 19th centuries,

writers and philosophers would frequently secure investment, or the pledge of

investment, for their next work.

In time, the concept was applied well beyond the arts; the pedestal for the

Statue of Liberty was only completed after a public appeal and over 160,000

individual donations after government funding failed to come through. But it

wasn’t until the rise of the internet that projects in the creative and

entertainment industries were widely funded through direct grassroots campaigns.

Why Crowdfunding

Works

The success of crowdfunding goes beyond the ability to raise

large amounts of money in a short amount of time. The real power lays in the way

it combines fundraising and campaigning into a single activity.

What Is Crowd Funding

Crowdfunding is the funding of a

project or venture by raising many small amounts of money from a large number of

people, typically by the magic of the Internet. Crowdfunding is a form of

crowdsourcing and of alternative finance. In 2015, it was estimated that

worldwide over $34 billion was raised this way. But this is basically, very

little in the world of finance and business since this is a new concept (only a

few years new) and far from the standard business and multi-level-marketing

business.

Although similar concepts can also be executed through mail-order subscriptions,

benefit events, and other methods, the term crowdfunding refers to

Internet-mediated registries. This modern crowdfunding model is generally based

on three types of actors: the project initiator who proposes the idea and/or

project to be funded, individuals or groups who support the idea, and a

moderating organization (the "platform") that brings the parties together to

launch the idea, then it is promoted and not sold.

Crowdfunding has been used to fund a wide range of for-profit and non-profit,

entrepreneurial ventures such as artistic and creative projects, medical

expenses, travel, or community-oriented social entrepreneurship projects. Some

requests, such as those to pay for optional expenses such as vacations,

weddings, or cosmetic surgery, are widely described as internet begging or

cyberbegging (asking for support).

It’s taken a long time for

crowdfunding to reach the level of popularity that it now experiences since $2.7

billion dollars raised through crowdfunding in 2012 alone and exponentially

since. The popularity that crowdfunding has experienced has led to some

campaigns seeing phenomenal amounts donated for support to their projects and

huge numbers of people flocking to sites to get involved and donate.

Who uses crowdfunding sites?

Individuals: Those who

want to raise money for a special event, like a honeymoon, or need

financial assistance with an unexpected expense, such as a pet's

surgery, can do so on several crowdfunding platforms. Friends and family

can also set up projects that help a loved one with medical expenses or

accomplish a goal.

Non-profits/community activists:

Those looking to raise money for a good

cause can use crowdfunding sites to solicit funds from like-minded

individuals. This group might include teachers raising money for their

classrooms, individuals and groups seeking donations for volunteer trips

and charities seeking new revenue streams. Some platforms allow groups

to have a permanent presence to continually generate revenue.

Entrepreneurs: Startups

and/or existing businesses can use crowdfunding to get consumer

validation before they commit big money. No matter the size of the

company, crowdfunding is frequently used as an alternative avenue to

replace traditional venture capital money or unattainable bank loans.

Creative's: The

original early adopters of crowdfunding, artists such as writers,

gamers, and filmmakers, continue to capitalize on this new source of

revenue. They are more likely to get support on certain crowdfunding

platforms than on others.

In 1997, the British rock

group Marillion, gathered $60,000 to finance their US tour using an Internet

campaign, the “Tour Fund.”(crowdfunding)

2010-2011 Equity based crowdfunding: GrowVC and CrowdCube

In 2010, the creators of the "Kickstarter" project, tapped into

these elements to successfully crowdfund their TikTok+LunaTik Multi-Touch Watch

Kits. In less than one month, between November and December 2010, 13,512

“backers” pledged $942,578 of their $15,000 goal, setting the world record for

the largest amount of money raised using crowdfunding to date.

On the 3rd of November 2011, the US House of Representatives passed the

crowdfunding bill H.R. 2930 (known as the “Entrepreneur Access to Capital Act”)

that could allow startups to offer and sell securities through crowdfunding

sites and social networks.

Through online systems like

"Kickstarter" and "Indiegogo", stars are campaigning and asking fans to make

donations toward their personal creative projects through the Internet. LeVar

Burton's Reading Rainbow revamp has raised nearly $3.5 million on "Kickstarter"

while Don Cheadle was well on his way to reaching the "Indiegogo" goal for his

Miles Davis biopic. The guys join the ranks of other celebrities who have turned

to such crowdfunding donation platforms, including James Franco and Kristen

Bell, who raked in a record-breaking $5.7 million for her "Kickstarter" campaign

for the Veronica Mars movie. Zach Braff has also followed suit, crediting

Kristen's success for his decision to utilize the site for his latest film

project, "Wish I Was Here". Many more stars have taken to online campaigning!

Then in 2013, around the time

that the peer-to-peer online currency bitcoin was first gaining mainstream

attention, the idea of crowdfunding was fused with the new technology of

blockchain. The result was the ICO or Initial Coin Offering: a turbocharged way

to raise money in the era of the Internet. An ICO is a blockchain-powered

crowdfunding campaign. It has much in common with conventional crowdfunding, but

also key differences.

As with traditional crowdfunding, an ICO seeks to

secure investment for a new project from an interested community. In this

instance, funding is most likely to come in the form of bitcoin or other crypto

currencies. The nature of these digital currencies means that they can be sent

from all over the world, quickly and with almost zero cost, outside of the

legacy banking system. Anyone who has tried moving money abroad will recognize

the benefits of this.

Since then, 1000's of

crowdfunding platforms had joined the movement for financing an abundance of

projects such as: Kickstarter, Indiegogo, RocketHub, GoFundMe, Razoo, Crowdrise,

PledgeMusic, AppBackr, Sellaband, Crowdfunder, DonorsChoice, Fundable, Circleup,

MicroVentures, YouCaring, Kiva, Plumfund, fundmycause, CryptoElevation, Zarfund,

etc. etc. etc.

The concept of crowdfunding gathering small

amounts of investments or donations from a large number of people to fund

support for a specific business or objective was seen as a slightly wacky

way to raise money. Much as many football clubs would have loved their fans

to donate to a fund to buy Lionel Messi. However, since the financial crash

in 2008, crowdfunding has moved from the alternative to the mainstream as a

route to funding businesses. As a result, many sports clubs, governing

bodies and sports people have seriously begun to consider and use

crowdfunding as a platform to generate commercial funding.

From high-profile examples such as the Caterham

F1 team, to clubs and fan-groups attempting to generate funds to pay

sportspeople, the growth in this innovation is set to continue and offer

Sports Governing Bodies (SGBs) an alternative method of revenue generation

The crowdfunding platforms used for

sport's are "reward and donation" based crowdfunding. Athletes are coming up

with alternative ideas as to how to reward people, e.g. a swimming lesson

with them or being able to get the gear in which they competed. Funding of

sport's, particularly those in which the athletes are not professionals, can

be tough. For many athletes and teams, the difficulty is that in order to

qualify for the funding you need to be at a very high level. However, being

able to dedicate enough time to reach that level requires support.

Crowdfunding is a way for less mainstream

sport's to raise money, as in situations where UK and Scottish level funding

isn't there to the extent required to allow the athletes to train?

Crowdfunding platforms have been established solely for the purpose of

funding athletes. One example is Rallyme, a US-based platform for individual

athletes, teams or organizations to raise funding for their sporting goals.

A number of crowdfunding campaigns started

to gain pace on the run up to the Sochi 2014 Winter Olympics. The British

Nordic ski team raised £7705 to assist them with their training and

competitions in the run up to the Games while the Jamaican bobsled team also

managed to raise over £100,000 in just two days to help them get to the

Sochi Games.

In the run up to the Glasgow Commonwealth

Games in 2014 there were a number of crowdfunding campaigns to help get

athletes, not only to the Games themselves but also to fund warm weather

training camps and expenses. One girl from Jersey managed to raise £1490 to

attend a warm weather training camp with the GB team. Although these are

small amounts, athletes are managing to appeal to their fan base and fellow

sports fans to allow them to better themselves as athletes.

Another example from October 2014 was a

Scottish surfing team raising £4605 on the "Crowdfunder" platform, after

seeking only £3000. Surfing only managed to obtain formal governing body

recognition in summer 2014 therefore the sport is still quite new and

looking for ways to fund athletes. The money was to assist with the team's

accommodation and contribute towards flight costs for the team to go to Peru

for the International Surfing Association World Games.

Equity crowdfunding is the more serious

side of the industry, where investors get a share of the business they are

funding. One area of sport where equity crowdfunding has already been used

is in relation to football clubs, particularly those which have found

themselves in financial distress.

Fans and supporters are willing to get

behind their failed club to assist them in getting back on their feet.

Darlington Football Club successfully raised 110.1% of their initial target

of £50,000 with "Squareknot" in order to secure financial stability. This is

an example of equity crowdfunding being used as they were offering up to 14%

equity in the club depending on the amount invested.

Another recent example of a sports team

crowdfunding their way out of financial difficulty is the Caterham F1 team,

which entered administration in October 2014 and commenced a crowdfunding

campaign with "Crowdcube". They managed to raise more than £2.35 million.

To diversify slightly from team/athlete

funding, there are other ways in which crowdfunding can apply to sport. "Crowdracing"

is a new crowdfunding donation platform which allows investors to purchase

shares in race horses. The return for investors is based upon any winnings

and any proceeds from a sale of the horse.

In 2013, "Freedom to Ride" organized a

crowdfunding campaign which sought funding to create a Bristol Cycling

Manifesto and Cycling strategy which was used to influence decision makers

in creating a comprehensive cycling network for Bristol. Crowdfunding is

being used for funding sporting events locally, nationally and even

internationally. A crowdfunding campaign helped fund Merseyside's own darts

tournament. In all sectors, including sport, crowdfunding is filling a hole

where funding has not been available in the past.

Crowdfunding is certainly gaining

popularity as a way to obtain funding as a new business start-up, which is

reflected in the number of crowdfunding platforms being established. Many of

these are choosing to have a particular presence in Scotland including Crowdcube

- which has opened in Scotland - and Scottish platforms ShareIn and Squareknot.

Building A

Community Around A Story

The Obama campaign united their donors around the

message of Hope and Change in 2008. The American economy crashed, and the

fresh-faced African American Senator from Illinois represented a new kind of

politician and a new brand of politics. In 2012, the campaign continued that

story with the message “Moving Forward.”

Bryan Parker developed a similar message for his

mayoral campaign, adopting the hashtag #OaklandForward. Steve Hansen built a

community around his story as the underdog. Rep Joe Wilson used the power of

controversy to unite Obama-haters and compel them to donate.

The story a campaign tells is the hook that compels

people to donate. Posters, billboards, and campaign literature are limited in

their ability to communicate that story. But crowdfunding allows campaigns to

combine all of those mediums into one platform and update their supporters

regularly. This feature turns a campaign into a constantly evolving story that

people can take part in.

Large Groups Of

Small Donors

Financing a campaign with a large group of small donors

presents many advantages.

A donation is akin to an investment in the success of a

campaign. People who donate, small or large, will go to greater lengths to see a

return on their investment than those who don’t. As a result, they are more

likely to show up to the polls on election day.

But small donors are also more likely than large donors

to do crucial volunteer work, like making phone calls and handing out

literature. More small donors means more likely volunteers and more people

spreading the message of a campaign.

Small donors also provide a renewable resource of

donations. By September 2012, 51% of Mitt Romney’s contributors had donated the

legal maximum amount of $2,500, compared with just 16% of Obama’s supporters.

This allowed the campaign to go back to them for more money multiple times.

Convenience

Campaigning is expensive. Delivering messages to voters

eats up about 80% of a campaigns budget, which is why money matters in politics.

Crowdfunding makes fundraising more convenient than ever before.

The primary reason crowdfunding sites are so convenient

is because of the connectivity they provide. People are no longer required to

travel to a fundraiser in order to donate to their candidate or cause. Nor must

they rely on sending cash and checks in the mail. Candidates can link a

crowdfunding campaign to their website and social platforms, which puts

potential donors just one click away from contribution.

This connectivity also makes it infinitely easier for

supporters to spread the message of a campaign. Supporters can share pictures,

videos, and updates with their social networks. Candidates can also use these

social networks to reach people directly, giving their campaign greater access

to elusive, tech-savvy younger voters.

Like any business, crowdfunding sites have to make

money. Rally takes 4.5% of each donation, which seems small but can eventually

add up to a great deal of money. Still, the reduction in overhead expenses, like

renting rooms for fundraisers and the traditional costs of financial

transactions, make it well worthwhile. According to Hansen, “There are more fees

for processing online donations, but the benefits outweigh the costs.”

Chapter 1: Nature of the industries

The evolution of the industry

Modern peer-to-peer lending and equity crowd-funding

are relatively young; they started in the UK in 2006,10spread to the US in

2007andtookoff in China in 2009.11They are also still small, amounting to

around $6 billion in capital origination. Nevertheless, these industries are

growing rapidly. There are two main factors contributing to the rapid rise

of FR crowd-funding: 1) technological innovation; and 2) the financial

crisis of2008.

Technological advancement makes crowd-funding

viable

FR crowd-funding has been on the fringe of economic

activity for many years in various forms predicated on

convenience.12However, FR crowd-funding platforms only started to grow

substantively in 2006 in the UK after the technological innovation of

so-called Web 2.0 applications on the internet made it viable. Web 2.0

refers to a change in technology that allowed users of the internet to

participate in the creation of content hosted on stable websites. It

emphasizes the “wisdom of the crowds” in website design13and the development

of software to enable participation. Two examples of this type of technology

are Wikipedia and EBay, both of which allow multiple individuals to contribute

to the overall architecture of the website. This technological leap provided

the means to create peer-to-peer lending and equity crowd-funding

websites15making FR crowd-funding viable through reducing the cost of

transactions associated with providing these services. This style of website

architecture promotes user participation by allowing borrowers to set up a

profile; add pictures and describe how they will use the loan or

investment.16This provides the online platforms with a social-networking

aspect, with borrower/issuers voluntarily providing information to potential

investor/lenders. The online aspect cuts cost and is convenient for both the

borrower/issuer and lender/investor, in addition to increasing the potential

reach of this form of investment opportunity or capital raising facilities.

... Financial crisis and reduced business lending

by banks have left a gap in funding

The second factor explaining the evolution of FR

crowd-funding platforms is the financial crisis. The 2008 financial

crisis resulted in a number of bank failures and, consequently, the

implementation of new capital adequacy

regulations for banks, such as Basel III. As a result, credit

providers have become increasingly constrained in their ability to

lend money to the real economy. Figure 2 shows how the amount of

bank loans made in Western Europe and the USA dropped significantly

at the beginning of the crisis. While there have been some signs of

recovery in the US (although the growth rate is still below

pre-crisis levels), in Western Europe the growth rate in loans to the

non-financial corporate sector has been negative, especially to SMEs

in the EU.

In this funding vacuum, peer-to-peer lending is

growing in popularity as bank liquidity is reduced and new regulatory

requirements make obtaining loans for small and medium enterprises and

individuals difficult.17Lending to SMEs, as well as the financing of

personal loans fell during the crisis,18leaving a gap in the market in loans

to SMEs and personal loans. Additionally, as highlighted in IOSCO’s Risk

Outlook 2013-2014,19quantitative easing in many jurisdictions has driven

interest rates close to their zero lower bound (see Figure 3). This in turn

has driven a “search for yield” pushing investors towards alternative forms

of income generation. In this climate, peer-to-peer lending has developed as

a vehicle for borrowers to obtain a loan at a lower interest rate than through

using traditional avenues of credit provision such as banks.

Additionally, peer-to-peer lending offers a higher rate of return than

through traditional investments, such as a savings account or government

bonds. Further, many savers have inflation adjusted deposit rates that are

often negative, impelling them to search for better returns on their savings.

Consequently, growth in the peer-to-peer lending market has been exponential,

particularly after 2010 when the industry self-imposed restrictions on

borrower creditworthiness in order to tackle high default rates, e.g. when

Prosper saw default rates of 30

% in 2009.20Figures obtained through data gathering

and market intelligence suggest a 100% year-on-year growth rate since 2010.

This is discussed further later in this paper.

The rise of Financial Return crowd-funding

Since its inception in the UK and USA in 2006,

peer-to-peer lending has emerged in many other jurisdictions, spreading to

China and South East Asia in 2009.22However, most of the peer-to-peer

platforms have only been set up in the last three years, with very small

fledgling platforms in Argentina, Italy, Estonia and India, amongst

others. Figure 4 shows the percentage of the overall amount of loans

originated through FR crowd-funding platforms by country. Collectively, the

US, UK and China make up 96% of the overall FR crowd-funding market: the US

market accounts for51% of the global market, with China

making up just over a quarter at 28%, and the UK

just behind at 17%. The size of the US and UK market makes up 68% of the

FR crowd-funding market, which amounts to just over $4.3 billion. They

are also the oldest markets, as these types of platforms were first

established in these jurisdictions. Figure 5 also shows that the size of

the FR crowd-funding market in South East Asia is quite large, making up

28% of the overall global market, according to the market data available.

The lowest estimated market value for China, based on data available at

the platform level, is half that of the US, at $1.8billion, though

market intelligence suggests this figure is much higher than the data

available. Current data shows that China and South Korea make up 95% of

the total Asian market

The regulation of equity crowd-funding

Three regulatory regimes can be identified in equity

crowd-funding. The first regime is where regulation bans

equity crowd-funding.In the second case, equity crowd-funding is legal but

regulation creates high barriers to entry; in these jurisdictions there is

no equity crowd-funding market. Under the last regime, regulation imposes

strict limits on who can invest in this form of equity, usually limiting

it to sophisticated investors, the number of investors allowed to invest, the

size of the company issuing the equity and other similar regulatory

requirements. As such, equity crowd-funding is a very small market. Recent

changes in legislation have been aimed at encouraging the equity

crowd-funding market to grow, as is the case, for example, with the JOBS Act in

the US. Equity crowd-funding has started to develop, boosted by the

introduction of the JOBS Act. It is currently limited to sophisticated

investors, as defined by US law. Platforms are required to check that

investors comply with SEC rules. These rules could include a limit of $2,000

or 5% of annual income on the amount an investor can invest, if his annual

income and net worth are less than $100,000,. This limit increases to10% if

the investor ́s annual income is over $100,000. However, the higher

threshold may be extended to retail investors after the SEC has finalized

the rules for the equity crowd-funding platforms and the issuers of the

equity

Current regulatory trends

Many jurisdictions now consider peer-to-peer lending

and equity crowd-funding platforms as an efficient vehicle for funding

start-ups as well as small and medium enterprises. But many are seeking to

encourage the practice without compromising investor protection through

specific, targeted regulation of the industry. Given that the industry is

relatively young (or non-existent) in many countries, a number of

consultation papers have been issued on this topic balancing encouraging FR

crowd-funding and investor protection (see Box 3). None of the changes

proposed under these consultations have yet come into force.

Crowdfunding asks innumerable individuals to contribute

small amounts of money in support of a goal, project or new

organization—even if the ”funding applicants” are unincorporated,

experimental or short-term. Crowdfunding decreases the time required to

identify and vet solutions, helps mobilize donors and project backers

outside the network of the initiating organization, generates richer sources

of data from stakeholders, and allows for incremental program building while

funds are being collected.

Crowdfunding augments the annual donor campaign model and facilitates

deeper engagement between financial backers, the network, and the targets of

the program. while the concept of crowdfunding may give securities and tax

regulators pause, it presents a considerable opportunity for global solution

networks to overcome the limitations and challenges of obtaining funding

through traditional channels.

idea in Brief

Crowdfunding, the use of online platforms to gather small

amounts of money from a large and distributed network of individuals, has

become a multi-billion dollar industry since its inception less than a

decade ago. Entities ranging from start-ups to non-profits and individuals

to large multinational corporations, have utilized crowdfunding to

underwrite the development of products and services, support artistic

endeavors and finance a variety of non-profit initiatives. Among the early

adopters of crowdfunding are global solution networks (GSNs), which can be

defined as digitally-enabled multi-stakeholder networks that have

self-organized to address a global problem. Numerous GSNs are using

crowdfunding to diversify their capital base and develop innovative

products, services, and programs aimed at addressing issues ranging from

climate change to vaccination. Crowdfunding can enable GSNs to overcome the

obstacles posed by traditional funding sources, including the reduction in

available capital post-financial crisis, the slow decision making cycles of

traditional funders, and the inability or unwillingness of major donors to

fund risky or newly established and unincorporated entities. Successful

crowdfunding requires considerable skill, resources, knowledge about

regulatory constraints, and integrity on behalf of participants. despite

these potential obstacles, a growing number of success cases demonstrate

that GSNs can leverage the power of the crowd to create, sustain, and fund

networks organized around shared interest with shared investment in the

outcomes.

introduction

in 2012, a small team of passionate journalists and

development professionals hatched a new idea for empowering isolated and

disadvantaged communities in Africa and Asia to send out urgent news alerts

to the global media.1After serving as independent reporters in some of the

world’s toughest environments, Alice Klein and Libby Powell conceded that

even the most principled and persistent journalists could not make up for

the fact that the voices of women, minority groups, and people without

access to the internet or computers are largely excluded from mainstream

news reporting. in the search for solutions, the pair realized that the

growing ubiquity of mobile phones offered new opportunities for direct

engagement and could empower communities to share their own news and

perspectives via text messaging. However, individuals in these communities

would need access to the right tools and the right training, so together the

two women founded radar, a network of journalists dedicated to advancing

citizen journalism in communities that are too often neglected by global

media conglomerates.

The network has since provided training workshops in

Kenya, Sierra Leone, and india—supporting over 250

citizen mobile reporters who have shared more than 2,000 mobile reports.3As

the network grew, so too did the scope of radar’s

reporting. with increasingly sensitive subject

matter—including corruption, gender violence, and slavery—security became a

concern, both for their data and for their reporters. Klein and Powell

decided to develop a new digital platform that could better connect their

reporters, protect their data, and allow radar to work

with a greater number of reporters simultaneously. However, building a

platform required money and expertise that neither Klein nor Powell

possessed. in August 2013, radar launched a campaign to

raise the funds they required. But rather than turning to traditional

funding sources such as the uK’s department for international

development, the world Bank, or

the uN, radar turned to indiegogo, a crowdfunding

platform used by capital-seeking start-ups around the world. At the time,

Klein described crowdfunding as “a new and innovative way to raise funds

swiftly.”4i n deed, the campaign was ultimately

successful, raising £1000 in 24 hours and over £5000 in total. This was

enough funding for radar to complete development of a

prototype and initiate testing. Klein says that when the new platform will

enable radar to “set up new networks and ensure those

we’ve trained elsewhere have the tools they need to continue their great

work. it will also allow us to receive, verify and edit stories on the go

via a bespoke web app.”

Models of Crowdfunding

Crowdfunding has emerged globally in recent years, as

major platforms such as indiegogo and Kickstarter

launched in 2008 and 2009 respectively. As a model of fundraising,

crowdfunding has evolved quickly from an unregulated form of donating or

sponsoring a project (popular with artists and basement entrepreneurs) to a

well-recognized source for start-up and growth capital—even encouraged by

law as a solution to the global recession and now promoted by formal

associations of crowdfunding advocates. Kickstarter alone has been used to

raise over $1 billion uSd for 75,000 projects

initiated by more than 7.6 million people.12i n 2013,

the 3 million people who backed projects on Kickstarter that year came from

214 countries and territories on all seven continents, including

Antarctica.13Crowdfunding has skyrocketed in popularity since 2008 and this

success is largely attributed to its democratic nature, its ability to

foster engaging relationships between producer and consumer, and the desire

of all participants to become part of a mutually supportive community for

new ideas.14This popularity is translating into accelerated growth for the

industry, which crowdfunding pioneer ruth Hedges

predicts will be worth $3.2 trillion by 2020, creating 20 million jobs

during that time.

when used to test and launch new solutions, crowdfunding

may be a perfect test case for global problem solving. Crowdfunding can be

thought of as a petri dish that combines focus groups, testing of marketing

messaging, donor recruiting, partner recruiting, social media outreach, and

fundraising. Crowdfunding is a social process, driven by the feedback and

interaction from the crowd that has the potential to make capital allocation

more efficient and effective. in the case of GSNs and other fund-seekers,

crowdfunding makes it possible to see traction without the need for large

scale capital. Today, there are several models of crowdfunding that allow

varying levels of financial engagement and collaboration in everything from

non-profit projects to the financing of for-profit firms. depending

on their focus and organizational set-up, GSNs have the potential to use

different types and models of crowdfunding to support their goals and engage

their stakeholders and constituents in constructive new ways. Crowdfunding is

available to GSNs in three broad types: donation and rewards crowdfunding;

“pre-sale” crowdfunding; and debit and equity crowdfunding. donation and rewards

Crowdfunding donation crowdfunding is the oldest and easiest form of

crowdfunding to understand. in many ways, it is identical to the donation

drives that charities and non-profits have long used to raise funds via

special events (e.g., charity marathons and telethons). However, with the

rise of the internet and social networks, this process

of fundraising is moving from offline pools to online funding platforms. in

a typical donation crowdfunding effort, an individual or group solicits

donations for a project that a person wants to launch—a creative endeavor, a

community project, or a new product. in donation crowdfunding, the crowd

donates money to support the project with no expectation of a financial

return. we see donation crowdfunding being used by schools seeking to

purchase supplies, friends looking to raise funds for an injured family

member, and even non-profits seeking to host a regional peace conference in

the Middle East. The donation model quickly evolved into rewards

crowdfunding—where project backers or donors receive rewards tied to their

level of contribution. Some of these rewards are tangible objects; some of

the rewards allow and encourage the donor to participate in some way. Game

mechanics, in the form of “scarcity,” are usually an important part of

rewards crowdfunding. By making certain rewards scarce there is more of a

desire for backers to grab that reward before it is gone. However, the goal

with this type of crowdfunding is to both reward the donor for participating

and encourage further involvement in the project. There is a moral

obligation to provide the promised reward, but no contractual obligations

are established. for a variety of reasons, rewards crowdfunding is most

likely to suit the needs of GSNs. To begin with, rewards crowdfunding is

highly flexible and allows the campaign originator to create a series of

rewards that appeal to different donor demographics and income levels. Since

campaigns are organic, the sponsor can add new rewards, change messaging, or

change the videos during the campaign, a practice that is usually illegal in

equity transactions as explained below. By creating unique rewards, the

organization can align its mission with unique products or experiences that

appeal to targeted donor groups while reinforcing its brand messaging.

donation and rewards crowdfunding also avoids the steep compliance costs and

legal risks associated with equity-based crowdfunding.

“Pre-sale” Crowdfunding Models

A variation of rewards crowdfunding is a model in which an

organization or entrepreneur offers a product for sale, before its

manufacture, through a pre-sale crowdfunding campaign. The entrepreneur

tests the market—“if i build it, will you buy

it?”—without committing the upfront marketing, production, and distribution

costs required to fully commercialize a new product. Some of the most

successful pre-sale projects use campaigns to solicit not only capital but

also feedback from the contributors that can be incorporated into product

design and marketing. Some recent campaigns, like the “pebble smartwatch,”

raised millions of dollars, essentially funding the process of taking a

prototype into production.16Entrepreneurs running successful pre-sales

campaigns gain a stronger hand when negotiating with investors, while

investors can lower their risks by making investments in products that have

been validated by customers. Pre-sale models can be leveraged by GSNs in two

ways. first, GSNs with a technology focus could use

the equivalent of a pre-sale model to turn novel technological prototypes

into solutions that can implemented at scale. for example, a GSN could

partner with a university or business accelerator to develop a viable

prototype and then rally constituents to support the individual or group

creating the solution through a coordinated crowdfunding campaign. in this

way, the GSN can validate the concept before funds are spent on production,

while the actual cost of moving the technology from prototype to production

is financed by outside supporters and end users. Second, GSN models focusing

on job creation or the economic empowerment of local entrepreneurs and

business owners could adopt pre-sale crowdfunding for access to non-diluted

capital—actual revenue from sales before initiating production.

Manufacturing and distribution can then be scaled to meet the demonstrated

demand and, if the GSN has larger stakeholders involved, then they may be

able to contribute iT resources, shipping, financial clearing, and other

business infrastructure that a start-up may otherwise lack. debt and Equity

Crowdfund investing while many GSNs may adopt a

non-profit structure due to their multi-stakeholder nature, the growing

importance of social enterprises in global problem solving makes it worth a

brief look at two additional forms of crowdfunding: debt and equity

crowdfund investing. These are distinct from donation/rewards/pre-sale

models in that entities are legally allowed to issue shares or debt

instruments, while participants have the opportunity to profit from their

investments rather than simply provide financial support for the project,

organization and firm seeking funding.Equity Crowdfunding with the collapse

of the global markets in 2008 and the tightening of the bank lending and

early stage finance, crowdfund investing has emerged as a robust alternative

to other forms of traditional finance for start-ups and small enterprises.

Now allowed by law in both the uS and Canada, this model involves the sale

of a securities instrument (stock) in a company through a regulated, online

platform. whether financing an individual company, or

financing a larger mediating organization, crowdfund investing can rapidly

raise millions of dollars from a distributed base of investors. unlike

donation or rewards crowdfunding, the purchaser of the security is expecting

some kind of financial gain from the transaction. for early stage ventures,

equity crowdfunding is the equivalent of moving the “friends and family”

round of financing online and including not just friends and family, but

also “followers

and fans.” it can also be a substitute or complement to

angel investing. for entrepreneurs and small enterprises, crowdfunding

platforms lower the barriers required to offer equity shares in their

companies and thereby enhance their access to capital. Taking the process of

raising funds online increases the pool of investors, encourages the use of

common platforms and standardized disclosures, speeds the funding lifecycle,

and creates shared repositories of information that can be accessed at any

time by investors or entrepreneurs. for GSNs, equity crowdfunding raises the

prospect that aspects of their global problem solving work could be

accomplished through social enterprises that access capital from

crowdfunding platforms. There are specific crowdfunding platforms that have

been created for this purpose. recently established sites such as Seedups

Canada and return on Change specifically connect

entrepreneurs to investors for equity crowdsourcing within securities

regulations.17Therefore, for-profit spin-offs could be created by GSNs to

generate new revenue streams that support the networks’ non-profit

activities. Equity-based crowdfunding also has an important role to play in

supporting entrepreneurship and employment creation in developing countries.

A 2013

report on crowdfunding by the world

Bank acknowledges this idea: Crowdfunding is still largely a developed-world

phenomenon but its potential to stimulate innovation and create jobs in the

developing world has not gone unnoticed. Substantial reservoirs of

entrepreneurial talent, activity, and capital lay dormant in many emerging

economies, even as traditional attitudes toward risk, entrepreneurship, and

finance stifle potential economic growth and innovation. developing

economies have the potential to drive growth by employing crowdfunding to

leapfrog the traditional capital market structures and financial regulatory

regimes of the developed world.18data collected by Crowdfund Capital

Advisors shows that crowdfunding by microenterprises leads to rapid

increases in revenue and creates employment—an average of 2.2 new employees

the year following a successful campaign.19Early data also shows that women

and men are equally effective at meeting their goals on crowdfunding

projects.20This suggests that crowdfunding by and for women can be a key

mechanism for channeling funds to women-run/owned enterprises—especially in

areas of the world where women may be locked out of capital markets.

GSNs fostering entrepreneurship or focusing on economic

opportunity should be aware that these new models may allow them to attract

investors from outside their country/region, recruit those investors to

promote the opportunity, and help recruit new investors. This social

financing was either not possible or even illegal until recent regulatory

changes opened the door to equity-based crowdfunding in many countries

around the world.

where does a small manufacturer or entrepreneur in a

developing or emerging nation turn for debt finance after exhausting

micro-enterprise lending facilities? in most cases, banks and other

institutions will not loan to microenterprises until they have a

multiple-year track record of positive earnings—in other words, after the

need for growth capital is over. debt crowdfunding is

emerging as a mechanism for small enterprises to receive debt capital for

growth, inventory, or cash reserves and could evolve as an important part of

the funding cycle for innovation in emerging markets. in debt-based

crowdfunding, individuals loan money to other individuals (peer-to-peer or

P2P) or to small businesses (peer-to-business or P2B) funding. The debt

platforms screen the applicants, underwrite the loans, assign an interest

rate, and then essentially create an auction market where individuals are

able to see available opportunities and loan parts of the total loan amount

to the individuals or businesses. one example of these types of platforms,

Lending Club, has coordinated over $6 billion uSd in

loans and paid over $590 million uSd in interest to

investors since 2007.21 According to Charles Muldow of foundation

Capital, this could be a $1 trillion market within 10 years.22The takeaway

for GSNs is that projects which may once have required a banking partner or

grant from a large foundation may now be able to use crowdfunding and social

networks to raise similar amounts of capital in a shorter period of time.

Although grants are obviously preferable to loans, debt crowdfunding could

play a role in funding more speculative investments or projects that would

not be entertained by more conservative donors in foundations and government

agencies.

The use of Crowdfunding with in the four Pillars of

Society

Crowdfunding has gained momentum within the four pillars

of society: government, business, civil society, and individuals. Each of

these uses and interacts with crowdfunding in a variety of interesting ways,

providing insight and opportunity for GSNs.

Public Sector

Elected officials throughout the world are studying how to

leverage crowdfunding and crowdfund investing to help their small and medium

enterprise sector, spur innovation, and fill funding gaps in their early

stage capital markets. Crowdfund investing, whether via debt or equity,

while nascent, exists in some form on every continent. while

developed economies are currently leading, models in Africa and South

America are emerging that allow diaspora investing in local enterprises.

Several nations have passed enabling legislation and more than a dozen

others are considering legalization of equity or debt crowdfunding. The

European Commission released a report in April 2014 strongly endorsing the

potential of crowdfunding citing its “high potential benefits for

innovation, research and development, and [its potential to] contribute to

growth, community development and job creation.”23The world

Bank is also experimenting with the concept. it has recently partnered with

local stakeholders in developing countries to explore the role of

crowdfunding to support a network of business accelerators with the capacity

to transform local development of climate change mitigation technologies.

The first of these centers—The Kenya Climate innovation

Center (KCiC)—recently launched in Nairobi, Kenya. The

KCiC and its sponsors are promoting the use of

crowdfunding by its member companies to secure reliable funding by providing

training, engaging the Nairobi community, engaging donors and investors from

the Kenyan diaspora, and working with regulatory stakeholders to create the

necessary legal framework.

Private SectorSocial

entrepreneurs and new enterprises have been using crowdfunding to gain

start-up capital and project financing since its formal inception in 2008.

However, large and well established businesses have also recognized the

potential of crowdfunding to build their brand amongst new demographics.

Crowdfunding is not just a funding mechanism—even for smaller companies. The

money is oftentimes the least important benefit and in any case less

important than increasing social reach with the opportunity to listen to

conversations about your brand or products in ways that are almost

unimaginable using a traditional facebook or Twitter

campaign.25Examples of companies using crowdfunding to amplify their “social

good” messaging are increasing. in 2013, dodge

partnered with rocketHub to launch the “dodge dart registry”

which allowed individuals and community groups to raise funds to purchase a

new car that would help solve a community problem or meet a community need.

in the end, 50 cars were financed through crowdfunding and the campaign

generated over one million social media impressions.

Civil SocietyNumerous

foundations and non-profit organizations are also adopting crowdfunding to

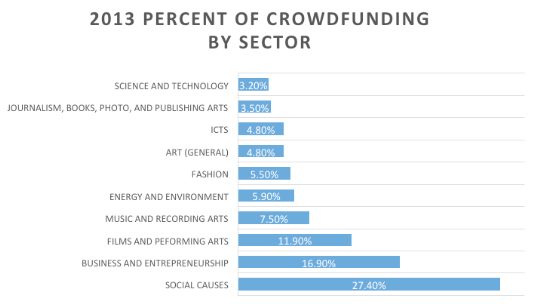

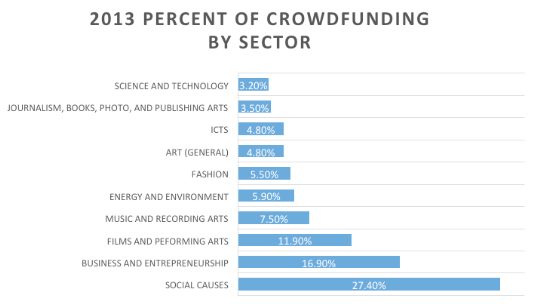

reshape the way they raise and disperse funds. According to the “2013

Crowdfunding industry report” by

Crowdsourcing.org, “social causes” raised more money via crowdfunding than

any other sector.

one example, the uK’s royal

Society for the encouragement of Arts, Manufacturers and Commerce (rSA)

is more than 250 years old and now operates as a think-tank addressing human

fulfillment and social progress. until 2013, the rSA awarded cash grants to

fellows through a competitive program called “Catalyst.” At this time, the

organization changed to place crowdfunding via Kickstarter at the heart of

its effort to support social innovators in the uK.28To support its Catalyst

fellows, the rSA now provides a combination of crowdfunding training,

mentorship, and a small initial donation (£1,000-2,000) to signal its

institutional commitment to the broader community.29Leveraging crowdfunding

allows the rSA to spread its funding over a larger number of projects. This

means more fellows and more projects get support and there is now less

internal frustration over the large number of worthy projects the rSA was

routinely turning down. individuals Crowdfunding has been called “the

democratization of philanthropy.”30According to ritu

Sharma, CEo of Social Media for Nonprofits: once upon a time, fundraising was

a pastime of the wealthy. Buttoned-up men and women in pearls hosted

elaborate galas, aimed at honoring just the right person in order to boost

attendance and support for their cause. Anyone who was anyone was invited,

expected to attend, and donate generously—because they could afford to....

The dawn of social fundraising has democratized fundraising so that deep

pockets are no longer required. Anyone with five dollars and a smartphone

can be a philanthropist. welcome, to the age of social

media—the great equalizer.31Crowdfunding offers a sense of community to

otherwise unconnected individuals, by leveraging existing communities and/or

creating entirely new ones. observations of successful

projects around the world show a similar pattern—a community forms around

the project/initiative, with strong social ties and sense of shared purpose.

Social cohesion starts to form around the project and the company or

organization. Sara Bannerman goes further, saying, “To the extent that

crowdfunding creates a sense of community and connectedness, it may also be

generative of a sense of public responsibility toward the project and the

creators involved for funders, and a sense of responsibility toward

investors on the part of creators.”32No other model of fundraising can be so

effective in creating an ad-hoc community around a project or program that

can then become part of the broader GSN.

Looking at the

participation by and opportunities for women in Crowdfunding.

By

Amy Dunn Moscoso –

Take a look

at the world of high tech entrepreneurs. Only about 10% of startup founders are

women, according to Compass, a startup research firm. Furthermore, only 5% of IT

investment goes to firms founded by women, according to PitchBook, another

research firm.

Recently

though, women have rattled the old boys’ club and smashed through some

significant glass ceilings.

-

Marissa Mayer, pregnant, becomes CEO of Yahoo

- Janet

Yellen is named Federal Reserve Chair by President Obama

- Millennial woman,

from 18 to 24, close the income gap for the first time in a decade, earning

93 cents for every dollar made by a man. (In 2012, women’s hourly wages were

just 84% of what men made according to a

national study on work by the Pew Research Center.

- Female angel

investing rises nearly 10% in one year to 21.8% in 2012, up from 12.2% in

2011, according to the

annual report of the Center for Venture Research at the University of

New Hampshire.

These are

significant strides, yes. But what about the future?

Millennial women are

pessimistic. In spite of Marissa Mayer, young women fear the effects that

motherhood will have on their earnings. With

54% of millennials wanting to start a business, where will the

money for women come from?

Crowdfunding: A viable

fundraising platform for women?

In June

2012, musician and artist

Amanda Palmer went on Kickstarter, a

website that helps people raise money for creative projects. Amanda asked for

$100,000 to fund an album and a tour. Instead, she raised

1.2 million with pledges from 24, 883 people.

This money empowered Amanda and her band, The Grand Theft Orchestra, to do a

book, an album and a world tour.

Kickstarter is one of the

most well-known crowdfunding sites. Crowdfunding involves using a platform to

raise funds for a project, business or cause. Instead of asking for a large

amount of money from a bank or investors, founders ask for small amounts of

money from a large pool of investors or donors on the Internet.

Currently,

there are hundreds of crowdfunding sites. New niche platforms are popping up

everywhere to raise funds for movies, start-ups and causes.

Several of

these sites are led by women.

Top crowdfunding sites

with female leaders

Crowdfunding has several women leaders who are founders, executives or both.

-

Indiegogo. One the most popular sites, Indiegogo was founded at the

Sundance festival to finance independent films. It now covers many

categories. Danae Ringelmann was one of three founding members who launched

the site in 2007. Today, she is the Chief Customer Officer. Indiegogo claims

that 42% of funded campaigns are led by women. [https://blog.indiegogo.com/2010/12/indiegogo-vs-venture-capital-women-34-more-successful.html]

-

Plum

Alley. Deborah Jackson is Founder and CEO. She added crowdfunding

to her e-commerce site in 2013. The site focuses solely on products

developed by women.

-

Crowdfunder. Rita Ravindra is the Chief Operations Officer

here. This site serves small businesses, start-ups and social enterprises.

While other

crowdfunding sites have women at the helm, a look through executive teams of

several top sites, including Kickstarter, shows that many are still 100%

founded, led and managed by men.

Best and worst

crowdfunding categories for women:

In what

crowdfunding categories do women do well? Kickstarter stats shed some insight.

With 13

categories, $958 million dollars raised and 55,486 funded projects, the category

breakdowns still show that men and companies dominate both raising the

greatest amount of money and in popularity.

Women

perform differently, however,

across categories.

- Publishing. This

category has 15,786 projects, a 32% success rate and 36.66 million

successfully raised. Two of the most funded and five of the most popular

campaigns in this category are women led.

- Music. This one of

the most popular categories on Kickstarter with 27, 100 projects and a 55%

success rate. While Amanda Palmer’s project has raised the

most funds, her campaign is the only women led campaign in the top 10

most funded projects. Two women led campaigns appear in the top 10 most

popular.

- Film and Video. With

32,548 projects, a 40% success rate and 1.59 million successful dollars

raised there are no women led campaigns in the top 10 most funded or most

popular.

- Technology. At 3,599

projects, a 35% success rate, 95 million successful dollars raised, the top

10 most funded campaigns are led by eight companies and two men.

For all campaigns,

companies dominate the top 10 projects for funding, along with two men. Only one

women led campaign appears in the top 10 for popularity. Hello Ruby is

led by Linda Liukas and falls under the publishing category.

Female Factors in

Crowdfunding Success

While women

might not be raising the greatest amounts of money, or be leading the most

popular campaigns, they are experiencing greater success than men on Indiegogo.

Indiegogo’s

blog

documents female success. Women led campaigns:

- Get

1.3 more contributors than male led campaigns

- Raise

an average at 10.75% more money

What kinds

of advantages and skills equal success for women crowdfunders?

- Social Media Skills.

Amanda Palmer’s savvy command of social media and her extremely loyal

following helped drive mass support. With 74% of women active on social

media, according to The Pew Research Center, women can reach a vast

audience.

- Team Work. Indiegogo

states on their website that those with “teams raise 80% more funds than

those run by an individual”. Creative projects benefit from a team that

works collaboratively, a style employed by women [http://www.magazine.utoronto.ca/leading-edge/teamwork-men-vs-women-jennifer-berdahl-cameron-anderson/],

according to a study from the University of Toronto.

- Networking. Women

are good at forming relationships. A forthcoming book called Business

Networking and Sex [http://www.amazon.com/Business-Networking-Sex-Ivan-Misner/dp/1599184249]

states that women use networking to build relationships. That tends to

translate on crowdfunding sites.

“Get started as early

as you can, and don’t try to boil the entire ocean at once. Many people get

paralysis from analysis, where they design their perfect business plan, or

their perfect non-profit, or their perfect album, and when this analysis

keeps you from taking action, that’s no good.” – Danae

Ringlemann, Founder, Indiegogo (Source: Financial

Post – Indiegogo founder advises startups not to wait for perfect)

What holds women back

from raising funds?

While there

are many reasons that women tend not to make as much money as men, it’s often

touted that women negotiate less than men do. In crowdfunding, not asking for

large amounts of money, or for enough funding, may lead women to raise fewer

funds than men.

Is crowdfunding a

democratizing force in funding for women?

Perhaps.

What it may

democratize is who gets to invest.

That may be

the truly democratizing force. When women invest in women, money equality may

follow.

What do you

think? Share your opinion. Is crowdfunding the best way for women to raise

money?

“Most ideas in the

world are funded because they have the ability to make someone else’s money.

That’s what investment is, what lending is,” the co-founder of Kickstarter,

Yancey Strickler said. “Ninety-nine percent of ideas have no ambition to

create money whatsoever. The extent of the dream is, ‘I wanna make this.’ ”

– Yancey Strickler,

Kickstarter (Source: The

Wrap – Kickstarter Co-Founder Yancey Strickler: ‘We Don’t Care About Money’)

UNDER

CONSTRUCTION